Looking for safe investments with guaranteed returns backed by the Government of India?

Small savings schemes are a great choice — ideal for conservative investors, retirees, and long-term savers.

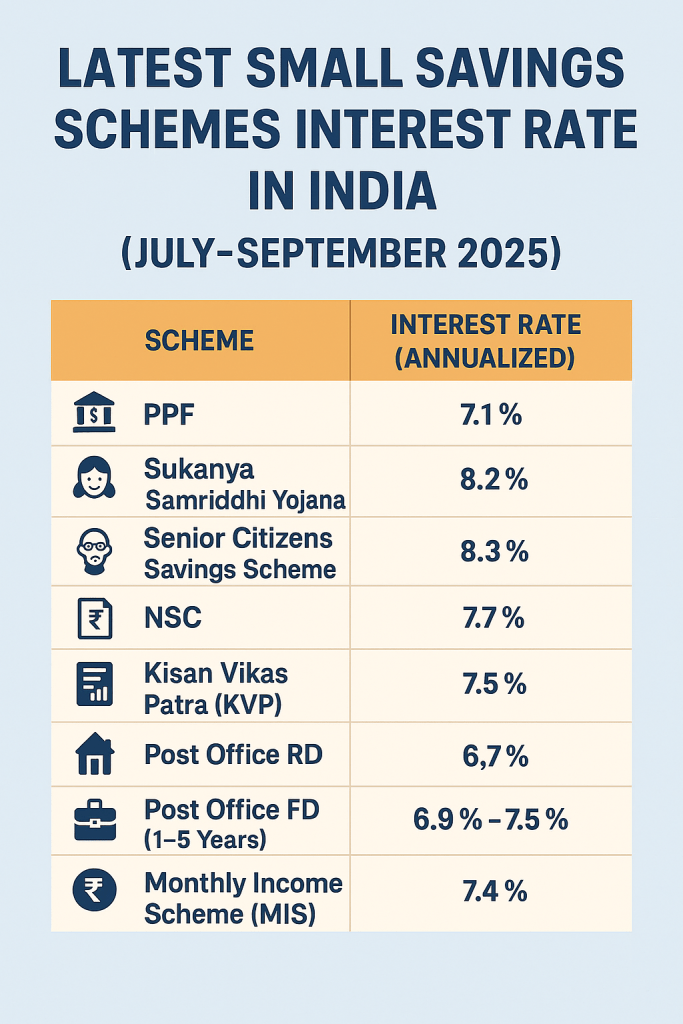

Here’s a full list of latest interest rates (July–September 2025) for all small savings schemes.

🔍 What Are Small Savings Schemes?

These are government-run savings plans like:

- PPF (Public Provident Fund)

- Sukanya Samriddhi Yojana

- Senior Citizens Savings Scheme

- NSC, KVP, Post Office RD and FD

They are low-risk and offer fixed, often tax-free or tax-saving, returns.

📊 Latest Small Savings Schemes Interest Rates (Q2 FY 2025–26)

| Scheme | Interest Rate (Annualized) |

|---|---|

| 🏦 PPF | 7.1% (Compounded yearly) |

| 👧 Sukanya Samriddhi Yojana | 8.2% (Compounded yearly) |

| 👴 Senior Citizens Saving Scheme (SCSS) | 8.3% (Quarterly payout) |

| 🧾 National Savings Certificate (NSC) | 7.7% (Compounded annually) |

| 💳 Kisan Vikas Patra (KVP) | 7.5% (Maturity in 115 months) |

| 🏠 Post Office RD | 6.7% (Compounded quarterly) |

| 💼 Post Office FD (1–5 Years) | 6.9% – 7.5% depending on term |

| 💳 Monthly Income Scheme (MIS) | 7.4% (Monthly interest payout) |

🔄 Updated quarterly by the Ministry of Finance, Government of India.

📌 Which Scheme is Best for You?

| Goal | Recommended Scheme |

|---|---|

| Long-term, tax-free savings | PPF (15 years) |

| Girl child’s future | Sukanya Samriddhi |

| Retirement income | SCSS, MIS |

| Safe post-tax returns | NSC, KVP |

| Monthly income | Post Office MIS |

✅ Tax Benefits

- 80C Benefits: PPF, Sukanya, SCSS, NSC

- Tax-Free Returns: PPF, Sukanya

- Taxable: Interest from MIS, RD, FD, SCSS

Always check the maturity, lock-in, and taxability before investing.

🔁 Related Posts:

- PPF vs FD – Which Is Better in 2025?

- Best Safe Investment Options in India

- Beginner’s Guide to Starting a PPF Account

- How to Save Tax on ₹5 Lakh Salary (India)

💬 Final Thought

Small savings schemes are perfect for those who want steady growth, capital protection, and peace of mind.

Whether you’re saving for retirement, a child’s education, or just want to park your money safely — these plans deserve your attention.

📬 Subscribe to WealthTalks Newsletter

Weekly money guides on savings, SIPs, tax tips, and smart investing — India-focused and beginner-friendly.

Leave a comment